PennantPark Floating Rate Capital Ltd. (PFLT): Price and Financial Metrics

PFLT Price/Volume Stats

| Current price | $11.21 | 52-week high | $12.63 |

| Prev. close | $11.26 | 52-week low | $9.69 |

| Day low | $11.16 | Volume | 423,100 |

| Day high | $11.28 | Avg. volume | 748,233 |

| 50-day MA | $11.71 | Dividend yield | 10.97% |

| 200-day MA | $10.97 | Market Cap | 690.85M |

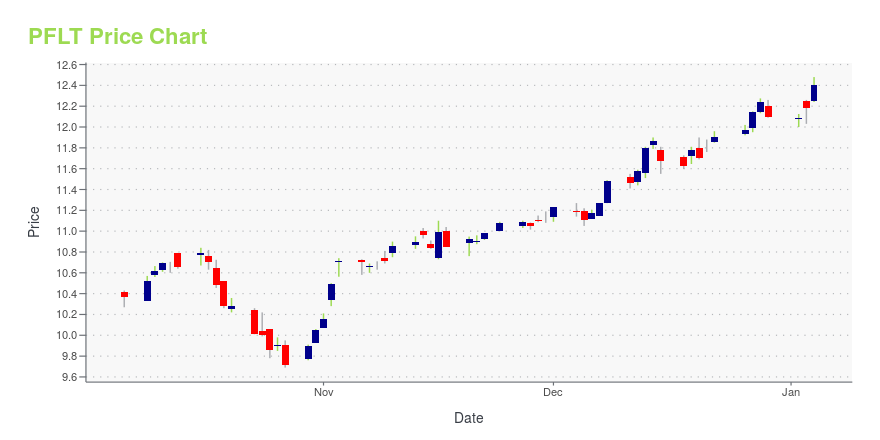

PFLT Stock Price Chart Interactive Chart >

PFLT POWR Grades

- Growth is the dimension where PFLT ranks best; there it ranks ahead of 76.46% of US stocks.

- The strongest trend for PFLT is in Growth, which has been heading down over the past 26 weeks.

- PFLT's current lowest rank is in the Value metric (where it is better than 25.25% of US stocks).

PFLT Stock Summary

- The ratio of debt to operating expenses for PENNANTPARK FLOATING RATE CAPITAL LTD is higher than it is for about 99.3% of US stocks.

- Over the past twelve months, PFLT has reported earnings growth of 133.31%, putting it ahead of 91.81% of US stocks in our set.

- The volatility of PENNANTPARK FLOATING RATE CAPITAL LTD's share price is greater than that of merely 2.14% US stocks with at least 200 days of trading history.

- Stocks with similar financial metrics, market capitalization, and price volatility to PENNANTPARK FLOATING RATE CAPITAL LTD are TSLX, MRCC, OCSL, BCSF, and CGBD.

- Visit PFLT's SEC page to see the company's official filings. To visit the company's web site, go to index.php.

PFLT Valuation Summary

- PFLT's EV/EBIT ratio is 13.9; this is 16.32% higher than that of the median Financial Services stock.

- PFLT's EV/EBIT ratio has moved NA NA over the prior 151 months.

Below are key valuation metrics over time for PFLT.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| PFLT | 2023-12-22 | 5.0 | 1.1 | 17.8 | 13.9 |

| PFLT | 2023-12-21 | 5.0 | 1.1 | 17.7 | 13.9 |

| PFLT | 2023-12-20 | 4.9 | 1.1 | 17.5 | 13.8 |

| PFLT | 2023-12-19 | 5.0 | 1.1 | 17.6 | 13.9 |

| PFLT | 2023-12-18 | 4.9 | 1.0 | 17.4 | 13.7 |

| PFLT | 2023-12-15 | 4.9 | 1.0 | 17.5 | 13.8 |

PFLT Growth Metrics

- Its 2 year cash and equivalents growth rate is now at 66.91%.

- Its 4 year net cashflow from operations growth rate is now at -28.38%.

- The 4 year net income to common stockholders growth rate now stands at -98.32%.

The table below shows PFLT's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 110.488 | 40.18748 | -12.598 |

| 2022-09-30 | 105.485 | -49.962 | 3.453 |

| 2022-06-30 | 98.31856 | -186.4371 | 20.59874 |

| 2022-03-31 | 93.49546 | -170.2095 | 40.39122 |

| 2021-12-31 | 88.29548 | -88.27243 | 44.81856 |

| 2021-09-30 | 82.69351 | 49.57163 | 56.51604 |

PFLT's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- PFLT has a Quality Grade of C, ranking ahead of 68.24% of graded US stocks.

- PFLT's asset turnover comes in at 0.074 -- ranking 272nd of 446 Trading stocks.

- MS, OFS, and DX are the stocks whose asset turnover ratios are most correlated with PFLT.

The table below shows PFLT's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.074 | 0.788 | 0.055 |

| 2021-03-31 | 0.074 | 0.786 | 0.053 |

| 2020-12-31 | 0.079 | 0.781 | 0.034 |

| 2020-09-30 | 0.079 | 0.783 | 0.025 |

| 2020-06-30 | 0.081 | 0.783 | 0.020 |

| 2020-03-31 | 0.082 | 0.783 | 0.015 |

PFLT Price Target

For more insight on analysts targets of PFLT, see our PFLT price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $13.33 | Average Broker Recommendation | 1.83 (Hold) |

PennantPark Floating Rate Capital Ltd. (PFLT) Company Bio

PennantPark Floating Rate Capital Ltd. is a business development company. The Company is a closed-end, externally managed and non-diversified investment company. Its investment objectives are to generate current income and capital appreciation by investing primarily in floating rate loans and other investments made to the United States middle-market companies. The company is based in New York City, New York.

Latest PFLT News From Around the Web

Below are the latest news stories about PENNANTPARK FLOATING RATE CAPITAL LTD that investors may wish to consider to help them evaluate PFLT as an investment opportunity.

7 Growth Stocks That Also Pay Monthly Dividends: December 2023While it’s obvious there are great reasons to buy and hold stocks, it’s also easy to overlook a regular income gained by owning monthly dividend-paying growth stocks. |

PennantPark Floating Rate Capital Ltd. Announces Monthly Distribution of $0.1025 per ShareMIAMI, Dec. 04, 2023 (GLOBE NEWSWIRE) -- PennantPark Floating Rate Capital Ltd. (the "Company") (NYSE: PFLT) (TASE: PFLT) declares its monthly distribution for December 2023 of $0.1025 per share, payable on January 2, 2024 to stockholders of record as of December 18, 2023. The distribution is expected to be paid from taxable net investment income. The final specific tax characteristics of the distribution will be reported to stockholders on Form 1099 after the end of the calendar year and in the |

PennantPark Floating Rate Capital Ltd. Announces Financial Results for the Fourth Quarter and Fiscal Year Ended September 30, 2023MIAMI, Nov. 15, 2023 (GLOBE NEWSWIRE) -- PennantPark Floating Rate Capital Ltd. (NYSE: PFLT) (TASE: PFLT) announced today financial results for the fourth quarter and fiscal year ended September 30, 2023. HIGHLIGHTS Quarter ended September 30, 2023 (Unaudited) ($ in millions, except per share amounts) Assets and Liabilities: Investment portfolio(1) $1,067.2 Net assets $653.6 GAAP net asset value per share $11.13 Quarterly increase in GAAP net asset value per share 1.6%Adjusted net asset value pe |

PennantPark Floating Rate Capital Ltd. Schedules Earnings Release of Fourth Fiscal Quarter 2023 ResultsMIAMI, Oct. 13, 2023 (GLOBE NEWSWIRE) -- PennantPark Floating Rate Capital Ltd. (the "Company") (NYSE: PFLT) (TASE:PFLT) announced that it will report results for the fourth fiscal quarter ended September 30, 2023 on Wednesday, November 15, 2023 after the close of the financial markets. The Company will also host a conference call at 9:00 a.m. (Eastern Time) on Thursday November 16, 2023 to discuss its financial results. All interested parties are welcome to participate. You can access the confe |

7 Great Growth Stocks That Pay a Monthly DividendThe only thing better than growth stocks are finding growth stocks that pay a monthly dividend. |

PFLT Price Returns

| 1-mo | -3.97% |

| 3-mo | 5.47% |

| 6-mo | 13.50% |

| 1-year | 13.87% |

| 3-year | 26.31% |

| 5-year | 43.20% |

| YTD | -5.72% |

| 2023 | 23.01% |

| 2022 | -5.53% |

| 2021 | 32.64% |

| 2020 | -1.41% |

| 2019 | 14.63% |

PFLT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PFLT

Here are a few links from around the web to help you further your research on PennantPark Floating Rate Capital Ltd's stock as an investment opportunity:PennantPark Floating Rate Capital Ltd (PFLT) Stock Price | Nasdaq

PennantPark Floating Rate Capital Ltd (PFLT) Stock Quote, History and News - Yahoo Finance

PennantPark Floating Rate Capital Ltd (PFLT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...