Monroe Capital Corporation (MRCC): Price and Financial Metrics

MRCC Price/Volume Stats

| Current price | $7.29 | 52-week high | $8.85 |

| Prev. close | $7.25 | 52-week low | $6.69 |

| Day low | $7.20 | Volume | 69,100 |

| Day high | $7.32 | Avg. volume | 69,855 |

| 50-day MA | $7.22 | Dividend yield | 13.72% |

| 200-day MA | $7.51 | Market Cap | 157.95M |

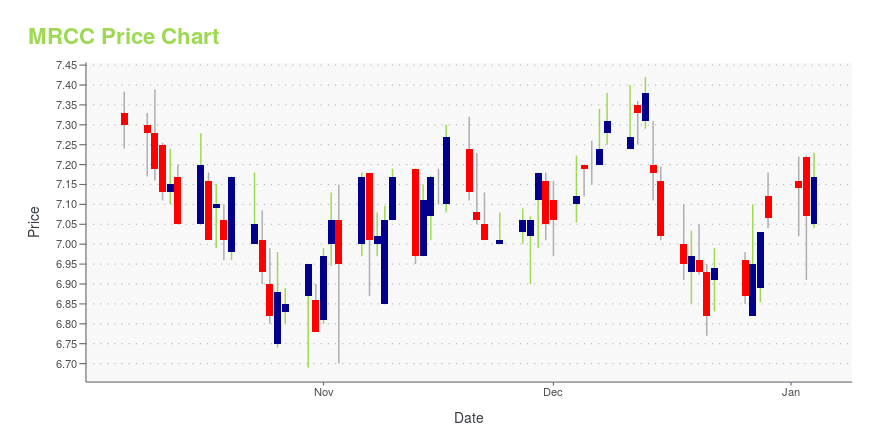

MRCC Stock Price Chart Interactive Chart >

MRCC POWR Grades

- MRCC scores best on the Momentum dimension, with a Momentum rank ahead of 74.09% of US stocks.

- The strongest trend for MRCC is in Growth, which has been heading down over the past 26 weeks.

- MRCC ranks lowest in Quality; there it ranks in the 12th percentile.

MRCC Stock Summary

- With a price/earnings ratio of 46.89, MONROE CAPITAL CORP P/E ratio is greater than that of about 85.11% of stocks in our set with positive earnings.

- Of note is the ratio of MONROE CAPITAL CORP's sales and general administrative expense to its total operating expenses; 87.34% of US stocks have a lower such ratio.

- The ratio of debt to operating expenses for MONROE CAPITAL CORP is higher than it is for about 99.28% of US stocks.

- Stocks with similar financial metrics, market capitalization, and price volatility to MONROE CAPITAL CORP are PNNT, PFLT, BCSF, CGBD, and TSLX.

- Visit MRCC's SEC page to see the company's official filings. To visit the company's web site, go to www.monroebdc.com.

MRCC Valuation Summary

- MRCC's price/sales ratio is 2.4; this is 100% higher than that of the median Financial Services stock.

- MRCC's price/sales ratio has moved down 47.6 over the prior 134 months.

Below are key valuation metrics over time for MRCC.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| MRCC | 2023-12-22 | 2.4 | 0.7 | 46.0 | 18.1 |

| MRCC | 2023-12-21 | 2.3 | 0.7 | 45.2 | 18.0 |

| MRCC | 2023-12-20 | 2.3 | 0.7 | 45.9 | 18.0 |

| MRCC | 2023-12-19 | 2.4 | 0.7 | 46.2 | 18.1 |

| MRCC | 2023-12-18 | 2.4 | 0.7 | 46.1 | 18.1 |

| MRCC | 2023-12-15 | 2.4 | 0.7 | 46.6 | 18.1 |

MRCC Growth Metrics

- Its 4 year net income to common stockholders growth rate is now at -232.05%.

- Its year over year cash and equivalents growth rate is now at -53.82%.

- The 5 year revenue growth rate now stands at 47.38%.

The table below shows MRCC's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 54.441 | 42.416 | -0.431 |

| 2022-06-30 | 53.739 | -0.973 | 7.557 |

| 2022-03-31 | 53.108 | 0.353 | 26.251 |

| 2021-12-31 | 53.83 | 20.008 | 32.459 |

| 2021-09-30 | 53.343 | 7.908 | 34.701 |

| 2021-06-30 | 51.514 | 81.335 | 42.647 |

MRCC's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- MRCC has a Quality Grade of C, ranking ahead of 68.26% of graded US stocks.

- MRCC's asset turnover comes in at 0.093 -- ranking 228th of 444 Trading stocks.

- MKTX, WRE, and PIPR are the stocks whose asset turnover ratios are most correlated with MRCC.

The table below shows MRCC's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.093 | 0.789 | 0.059 |

| 2021-06-30 | 0.091 | 0.812 | 0.070 |

| 2021-03-31 | 0.105 | 0.836 | 0.073 |

| 2020-12-31 | 0.105 | 0.841 | 0.022 |

| 2020-09-30 | 0.111 | 0.828 | 0.017 |

| 2020-06-30 | 0.111 | 0.820 | 0.005 |

MRCC Price Target

For more insight on analysts targets of MRCC, see our MRCC price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $10.56 | Average Broker Recommendation | 1.5 (Moderate Buy) |

Monroe Capital Corporation (MRCC) Company Bio

Monroe Capital LLC is a private equity firm specializing in bridge loans, exit financing, capital restructuring, buyouts, leveraged recapitalizations, turnaround, growth capital, acquisition, expansion, refinancings, balance sheet restructurings, portfolio acquisitions, unitranche financings, senior and junior debt, mezzanine debt, second lien or last-out loans, senior loans, equity co-investments for both ESOP and non-ESOP transactions and acquisitions of distressed debt. The company was founded in 2004 and is based in Chicago, Illinois.

Latest MRCC News From Around the Web

Below are the latest news stories about MONROE CAPITAL CORP that investors may wish to consider to help them evaluate MRCC as an investment opportunity.

Monroe Capital Corporation Announces Fourth Quarter Distribution of $0.25 Per ShareCHICAGO, Dec. 01, 2023 (GLOBE NEWSWIRE) -- Monroe Capital Corporation (the “Company”) (NASDAQ: MRCC) announced today that its Board of Directors has declared a distribution of $0.25 per share for the fourth quarter of 2023, payable on December 29, 2023 to stockholders of record as of December 15, 2023. In October 2012, the Company adopted a dividend reinvestment plan that provides for reinvestment of distributions on behalf of its stockholders, unless a stockholder elects to receive cash prior t |

Monroe Capital Corporation (NASDAQ:MRCC) Q3 2023 Earnings Call TranscriptMonroe Capital Corporation (NASDAQ:MRCC) Q3 2023 Earnings Call Transcript November 9, 2023 Operator: Welcome to Monroe Capital Corporation’s Third Quarter 2023 Earnings Conference Call. Before we begin, I would like to take the moment to remind our listeners that remarks made during this call today may contain certain forward statements — forward-looking statements, including statements […] |

Q3 2023 Monroe Capital Corp Earnings CallQ3 2023 Monroe Capital Corp Earnings Call |

Monroe Capital Corporation BDC Announces Third Quarter 2023 ResultsCHICAGO, Nov. 08, 2023 (GLOBE NEWSWIRE) -- Monroe Capital Corporation (Nasdaq: MRCC) (“Monroe”) today announced its financial results for the third quarter ended September 30, 2023. Except where the context suggests otherwise, the terms “Monroe,” “we,” “us,” “our,” and “Company” refer to Monroe Capital Corporation. Third Quarter 2023 Financial Highlights Net Investment Income of $5.4 million, or $0.25 per shareAdjusted Net Investment Income (a non-GAAP measure described below) of $5.5 million, o |

3 Business Development Companies Yielding Over 7%Business development companies (BDCs) often offer impressive dividend yields. |

MRCC Price Returns

| 1-mo | 1.53% |

| 3-mo | 6.88% |

| 6-mo | 6.61% |

| 1-year | -0.10% |

| 3-year | 9.68% |

| 5-year | 5.59% |

| YTD | 3.18% |

| 2023 | -5.68% |

| 2022 | -15.37% |

| 2021 | 53.23% |

| 2020 | -15.17% |

| 2019 | 27.79% |

MRCC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MRCC

Want to do more research on MONROE CAPITAL Corp's stock and its price? Try the links below:MONROE CAPITAL Corp (MRCC) Stock Price | Nasdaq

MONROE CAPITAL Corp (MRCC) Stock Quote, History and News - Yahoo Finance

MONROE CAPITAL Corp (MRCC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...