Oxford Square Capital Corp. - Closed End Fund (OXSQ): Price and Financial Metrics

OXSQ Price/Volume Stats

| Current price | $3.13 | 52-week high | $3.66 |

| Prev. close | $3.12 | 52-week low | $2.60 |

| Day low | $3.11 | Volume | 135,400 |

| Day high | $3.13 | Avg. volume | 241,218 |

| 50-day MA | $2.98 | Dividend yield | 13.42% |

| 200-day MA | $2.96 | Market Cap | 181.95M |

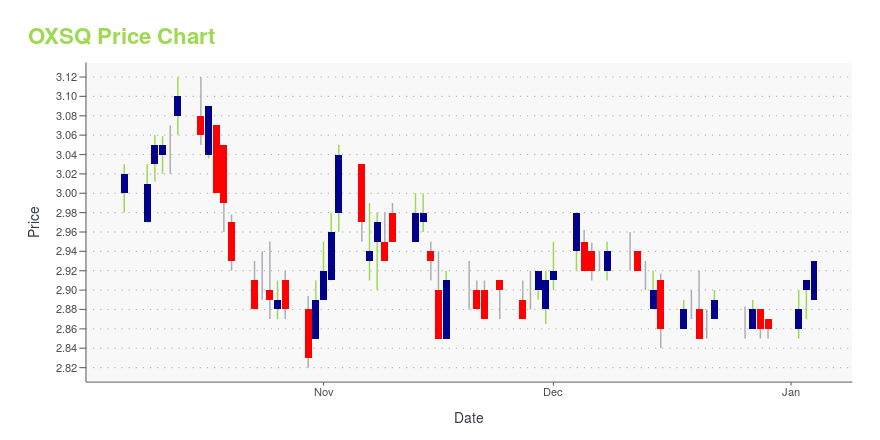

OXSQ Stock Price Chart Interactive Chart >

OXSQ POWR Grades

- Momentum is the dimension where OXSQ ranks best; there it ranks ahead of 74.09% of US stocks.

- OXSQ's strongest trending metric is Growth; it's been moving down over the last 26 weeks.

- OXSQ ranks lowest in Stability; there it ranks in the 40th percentile.

OXSQ Stock Summary

- The ratio of debt to operating expenses for OXFORD SQUARE CAPITAL CORP is higher than it is for about 97.44% of US stocks.

- In terms of volatility of its share price, OXSQ is more volatile than merely 3.62% of stocks we're observing.

- OXFORD SQUARE CAPITAL CORP's shareholder yield -- a measure of how much capital is returned to stockholders via dividends and buybacks -- is 33.95%, greater than the shareholder yield of 94.66% of stocks in our set.

- If you're looking for stocks that are quantitatively similar to OXFORD SQUARE CAPITAL CORP, a group of peers worth examining would be MBI, HASI, BNL, GECC, and WSR.

- Visit OXSQ's SEC page to see the company's official filings. To visit the company's web site, go to www.ticc.com.

OXSQ Valuation Summary

- In comparison to the median Financial Services stock, OXSQ's price/sales ratio is 22.22% higher, now standing at 3.3.

- OXSQ's price/earnings ratio has moved up 363.8 over the prior 243 months.

Below are key valuation metrics over time for OXSQ.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| OXSQ | 2023-12-22 | 3.3 | 1 | 94.8 | 21.6 |

| OXSQ | 2023-12-21 | 3.2 | 1 | 94.1 | 21.5 |

| OXSQ | 2023-12-20 | 3.2 | 1 | 93.5 | 21.4 |

| OXSQ | 2023-12-19 | 3.3 | 1 | 94.4 | 21.5 |

| OXSQ | 2023-12-18 | 3.3 | 1 | 94.4 | 21.5 |

| OXSQ | 2023-12-15 | 3.2 | 1 | 93.8 | 21.4 |

OXSQ Growth Metrics

- The 3 year revenue growth rate now stands at -34.07%.

- Its 5 year net cashflow from operations growth rate is now at -77.43%.

- Its 4 year price growth rate is now at -62.77%.

The table below shows OXSQ's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 41.37924 | 13.32425 | -62.75124 |

| 2022-06-30 | 39.77874 | -19.98319 | -40.33919 |

| 2022-03-31 | 37.68119 | -82.05965 | 9.59834 |

| 2021-12-31 | 37.17501 | -107.4296 | 39.58468 |

| 2021-09-30 | 35.63738 | -39.85888 | 79.22138 |

| 2021-06-30 | 34.06489 | -13.59518 | 88.80501 |

OXSQ's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- OXSQ has a Quality Grade of B, ranking ahead of 78.89% of graded US stocks.

- OXSQ's asset turnover comes in at 0.091 -- ranking 229th of 445 Trading stocks.

- MN, GEO, and EQR are the stocks whose asset turnover ratios are most correlated with OXSQ.

The table below shows OXSQ's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.091 | 0.850 | 0.203 |

| 2021-03-31 | 0.105 | 0.864 | 0.266 |

| 2020-12-31 | 0.118 | 0.874 | 0.024 |

| 2020-09-30 | 0.130 | 0.881 | -0.083 |

| 2020-06-30 | 0.136 | 0.883 | -0.193 |

| 2020-03-31 | 0.154 | 0.854 | -0.225 |

OXSQ Price Target

For more insight on analysts targets of OXSQ, see our OXSQ price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $4.75 | Average Broker Recommendation | 2 (Hold) |

Oxford Square Capital Corp. - Closed End Fund (OXSQ) Company Bio

Oxford Square Capital Corp. (formerly TICC Capital Corp.), a business development company, operates as a closed-end, non-diversified management investment company. The firm invests in both public and private companies. The company was founded in 2003 and is based in Greenwich, Connecticut.

Latest OXSQ News From Around the Web

Below are the latest news stories about OXFORD SQUARE CAPITAL CORP that investors may wish to consider to help them evaluate OXSQ as an investment opportunity.

Oxford Square Capital Corp. Reports Mixed Q3 Results and Announces Upcoming DistributionsFinancial Performance and Future Payouts Detailed for Investors |

Oxford Square Capital Corp. (NASDAQ:OXSQ) Q3 2023 Earnings Call TranscriptOxford Square Capital Corp. (NASDAQ:OXSQ) Q3 2023 Earnings Call Transcript November 7, 2023 Oxford Square Capital Corp. reports earnings inline with expectations. Reported EPS is $0.12 EPS, expectations were $0.12. Operator: Good morning, ladies and gentlemen. Welcome to the Oxford Square Capital Corp. Third Quarter 2023 Earnings Conference Call. My name is Jo Peter [ph]. […] |

Oxford Square Capital Corp. Announces Net Asset Value and Selected Financial Results for the Quarter Ended September 30, 2023 and Declaration of Distributions on Common Stock for the Months Ending January 31, February 29, and March 31, 2024GREENWICH, Conn., Nov. 07, 2023 (GLOBE NEWSWIRE) -- Oxford Square Capital Corp. (NasdaqGS: OXSQ) (NasdaqGS: OXSQL) (NasdaqGS: OXSQZ) (NasdaqGS: OXSQG) (the “Company,” “we,” “us” or “our”) announced today its financial results and related information for the quarter ended September 30, 2023. On November 2, 2023, our Board of Directors declared the following distributions on our common stock: Month EndingRecord DatePayment DateAmount Per ShareJanuary 31, 2024January 17, 2024January 31, 2024$0.035F |

Oxford Square Capital Corp. Schedules Third Quarter 2023 Earnings Release and Conference Call for November 7, 2023Greenwich, Conn., Nov. 02, 2023 (GLOBE NEWSWIRE) -- Oxford Square Capital Corp. (NasdaqGS: OXSQ) (NasdaqGS: OXSQL) (NasdaqGS: OXSQZ) (NasdaqGS: OXSQG) announced today that it will hold a conference call to discuss third quarter 2023 earnings on Tuesday, November 7, 2023 at 9:00 AM Eastern time. The toll free dial-in number is 1-833-470-1428, access code number 495860. There will be a recording available for 30 days after the call. If you are interested in hearing the recording, please dial 1-866 |

Oxford Square Capital Corp's Dividend AnalysisOxford Square Capital Corp (NASDAQ:OXSQ) recently announced a dividend of $0.04 per share, payable on 2023-11-30, with the ex-dividend date set for 2023-11-15. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's delve into Oxford Square Capital Corp's dividend performance and assess its sustainability. |

OXSQ Price Returns

| 1-mo | 5.17% |

| 3-mo | 12.55% |

| 6-mo | 13.71% |

| 1-year | 4.19% |

| 3-year | 18.57% |

| 5-year | -5.60% |

| YTD | 11.98% |

| 2023 | 9.19% |

| 2022 | -14.37% |

| 2021 | 47.13% |

| 2020 | -32.37% |

| 2019 | -5.32% |

OXSQ Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching OXSQ

Want to do more research on Oxford Square Capital Corp's stock and its price? Try the links below:Oxford Square Capital Corp (OXSQ) Stock Price | Nasdaq

Oxford Square Capital Corp (OXSQ) Stock Quote, History and News - Yahoo Finance

Oxford Square Capital Corp (OXSQ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...