TCG BDC, Inc. (CGBD): Price and Financial Metrics

CGBD Price/Volume Stats

| Current price | $15.39 | 52-week high | $15.89 |

| Prev. close | $15.25 | 52-week low | $13.07 |

| Day low | $15.11 | Volume | 193,700 |

| Day high | $15.47 | Avg. volume | 184,973 |

| 50-day MA | $15.30 | Dividend yield | 9.62% |

| 200-day MA | $14.70 | Market Cap | 781.74M |

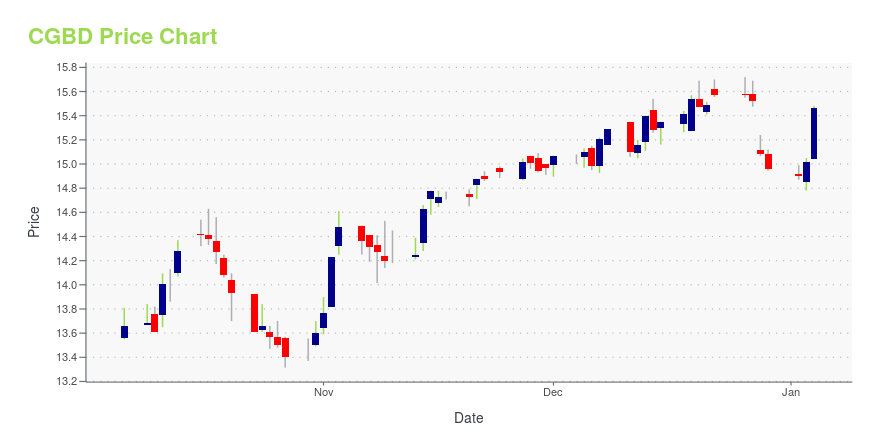

CGBD Stock Price Chart Interactive Chart >

CGBD POWR Grades

- CGBD scores best on the Momentum dimension, with a Momentum rank ahead of 74.09% of US stocks.

- CGBD's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- CGBD ranks lowest in Sentiment; there it ranks in the 31st percentile.

CGBD Stock Summary

- The ratio of debt to operating expenses for CARLYLE SECURED LENDING INC is higher than it is for about 99.26% of US stocks.

- The volatility of CARLYLE SECURED LENDING INC's share price is greater than that of merely 4.74% US stocks with at least 200 days of trading history.

- CARLYLE SECURED LENDING INC's shareholder yield -- a measure of how much capital is returned to stockholders via dividends and buybacks -- is 22.05%, greater than the shareholder yield of 92.28% of stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to CARLYLE SECURED LENDING INC are BCSF, MRCC, PNNT, PFLT, and TSLX.

- CGBD's SEC filings can be seen here. And to visit CARLYLE SECURED LENDING INC's official web site, go to carlyle-gms-finance-inc.

CGBD Valuation Summary

- In comparison to the median Financial Services stock, CGBD's price/sales ratio is 25.93% higher, now standing at 3.4.

- Over the past 79 months, CGBD's price/earnings ratio has gone up 2.5.

Below are key valuation metrics over time for CGBD.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| CGBD | 2023-12-22 | 3.4 | 0.9 | 11.0 | 12.0 |

| CGBD | 2023-12-21 | 3.3 | 0.9 | 11.0 | 11.9 |

| CGBD | 2023-12-20 | 3.3 | 0.9 | 11.0 | 11.9 |

| CGBD | 2023-12-19 | 3.4 | 0.9 | 11.0 | 12.0 |

| CGBD | 2023-12-18 | 3.3 | 0.9 | 10.9 | 11.9 |

| CGBD | 2023-12-15 | 3.3 | 0.9 | 10.9 | 11.9 |

CGBD's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- CGBD has a Quality Grade of B, ranking ahead of 75.04% of graded US stocks.

- CGBD's asset turnover comes in at 0.087 -- ranking 242nd of 444 Trading stocks.

- AMP, CME, and SCM are the stocks whose asset turnover ratios are most correlated with CGBD.

The table below shows CGBD's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.087 | 0.732 | 0.066 |

| 2021-06-30 | 0.087 | 0.732 | 0.062 |

| 2021-03-31 | 0.088 | 0.734 | 0.067 |

| 2020-12-31 | 0.091 | 0.741 | 0.014 |

| 2020-09-30 | 0.093 | 0.746 | 0.012 |

| 2020-06-30 | 0.097 | 0.751 | 0.000 |

CGBD Price Target

For more insight on analysts targets of CGBD, see our CGBD price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $14.25 | Average Broker Recommendation | 1.5 (Moderate Buy) |

TCG BDC, Inc. (CGBD) Company Bio

TCG BDC, Inc. is a non-diversified closed-end investment company. The fund operates as a business development company. The company provides debt investments in the U.S. middle market companies. It also invests in first lien and second lien senior secured loans; middle market junior loans, such as corporate mezzanine loans, equity co-investments, syndicated first lien and second lien senior secured loans, high-yield bonds, structured finance obligations, and other opportunistic investments. The company was founded in 2012 and is headquartered in New York, New York.

Latest CGBD News From Around the Web

Below are the latest news stories about CARLYLE SECURED LENDING INC that investors may wish to consider to help them evaluate CGBD as an investment opportunity.

Carlyle Secured Lending, Inc. Prices Public Offering of 8.20% Notes Due 2028NEW YORK, Nov. 13, 2023 (GLOBE NEWSWIRE) -- Carlyle Secured Lending, Inc. (Nasdaq: CGBD) (the "Company") today announced that it has priced an underwritten public offering of $75.0 million aggregate principal amount of 8.20% unsecured notes due 2028 (the "Notes"). The Notes will mature on December 1, 2028 and may be redeemed in whole or in part at any time or from time to time at the Company’s option on or after December 1, 2025. The Notes will bear interest at a rate of 8.20% per year payable q |

Carlyle Secured Lending, Inc. Announces Third Quarter 2023 Financial Results, Declares Fourth Quarter 2023 Dividends of $0.44 Per Common ShareNEW YORK, Nov. 07, 2023 (GLOBE NEWSWIRE) -- Carlyle Secured Lending, Inc. (together with its consolidated subsidiaries, “we,” “us,” “our,” “CSL” or the “Company”) (NASDAQ: CGBD) today announced its financial results for its third quarter ended September 30, 2023. The full detailed presentation of CSL’s third quarter 2023 results can be viewed here. Aren LeeKong, CSL’s Chief Executive Officer said, “In the face of broader market volatility, we are pleased to see our disciplined and intentional ap |

Carlyle Secured Lending, Inc. Schedules Third Quarter 2023 Financial Results and Investor Conference CallNEW YORK, Oct. 13, 2023 (GLOBE NEWSWIRE) -- Carlyle Secured Lending, Inc. (“Carlyle Secured Lending”) (NASDAQ: CGBD) will host a conference call at 10:00 a.m. EDT on Wednesday, November 8, 2023 to announce its third quarter 2023 financial results. A news release containing the quarterly results will be issued after market close on Tuesday, November 7, 2023. The conference call will be available via public webcast via a link on Carlyle Secured Lending’s website at carlylesecuredlending.com and wi |

Carlyle Secured Lending, Inc. Announces Second Quarter 2023 Financial Results, Declares Third Quarter 2023 Dividends of $0.44 Per Common ShareNEW YORK, Aug. 08, 2023 (GLOBE NEWSWIRE) -- Carlyle Secured Lending, Inc. (together with its consolidated subsidiaries, “we,” “us,” “our,” “CSL” or the “Company”) (NASDAQ: CGBD) today announced its financial results for its second quarter ended June 30, 2023. The full detailed presentation of CSL’s second quarter 2023 results can be viewed here. Aren LeeKong, CSL’s Chief Executive Officer said, “In spite of a complex economic backdrop, our portfolio continues to generate attractive income for ou |

Carlyle Secured Lending, Inc. Schedules Second Quarter 2023 Financial Results and Investor Conference CallNEW YORK, July 13, 2023 (GLOBE NEWSWIRE) -- Carlyle Secured Lending, Inc. (“Carlyle Secured Lending”) (NASDAQ: CGBD) will host a conference call at 10:00 a.m. EDT on Wednesday, August 9, 2023 to announce its second quarter 2023 financial results. A news release containing the quarterly results will be issued after market close on Tuesday, August 8, 2023. The conference call will be available via public webcast via a link on Carlyle Secured Lending’s website at carlylesecuredlending.com and will |

CGBD Price Returns

| 1-mo | -1.16% |

| 3-mo | 6.45% |

| 6-mo | 11.18% |

| 1-year | 12.23% |

| 3-year | 81.87% |

| 5-year | 96.85% |

| YTD | 2.87% |

| 2023 | 18.01% |

| 2022 | 17.70% |

| 2021 | 49.48% |

| 2020 | -8.34% |

| 2019 | 21.62% |

CGBD Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CGBD

Here are a few links from around the web to help you further your research on Tcg Bdc Inc's stock as an investment opportunity:Tcg Bdc Inc (CGBD) Stock Price | Nasdaq

Tcg Bdc Inc (CGBD) Stock Quote, History and News - Yahoo Finance

Tcg Bdc Inc (CGBD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...