Stellus Capital Investment Corporation (SCM): Price and Financial Metrics

SCM Price/Volume Stats

| Current price | $12.99 | 52-week high | $16.08 |

| Prev. close | $12.99 | 52-week low | $12.19 |

| Day low | $12.90 | Volume | 104,400 |

| Day high | $13.12 | Avg. volume | 115,273 |

| 50-day MA | $12.94 | Dividend yield | 12.31% |

| 200-day MA | $13.65 | Market Cap | 313.40M |

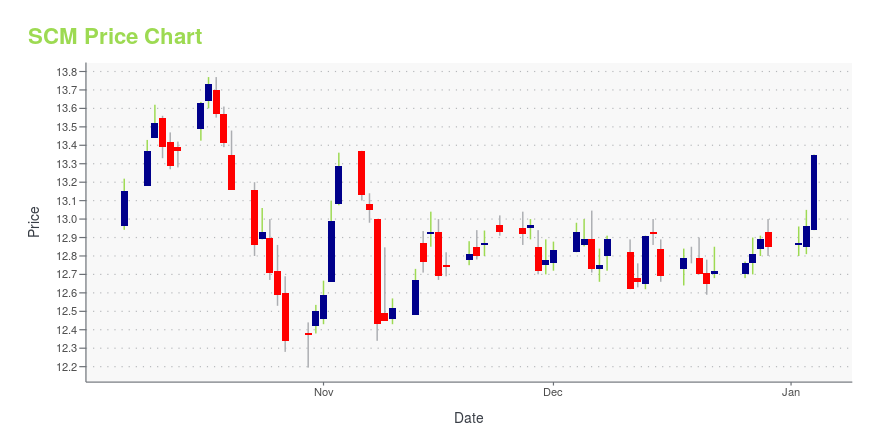

SCM Stock Price Chart Interactive Chart >

SCM POWR Grades

- SCM scores best on the Momentum dimension, with a Momentum rank ahead of 74.09% of US stocks.

- The strongest trend for SCM is in Growth, which has been heading down over the past 26 weeks.

- SCM ranks lowest in Quality; there it ranks in the 12th percentile.

SCM Stock Summary

- SCM's one year PEG ratio, measuring expected growth in earnings next year relative to current common stock price is 18,849.97 -- higher than 99.78% of US-listed equities with positive expected earnings growth.

- For SCM, its debt to operating expenses ratio is greater than that reported by 99.33% of US equities we're observing.

- In terms of volatility of its share price, SCM is more volatile than merely 7.94% of stocks we're observing.

- Stocks with similar financial metrics, market capitalization, and price volatility to STELLUS CAPITAL INVESTMENT CORP are THFF, BECN, EPD, SLRC, and CGBD.

- Visit SCM's SEC page to see the company's official filings. To visit the company's web site, go to about.pl.

SCM Valuation Summary

- SCM's price/sales ratio is 3; this is 150% higher than that of the median Financial Services stock.

- SCM's EV/EBIT ratio has moved down 117.2 over the prior 134 months.

Below are key valuation metrics over time for SCM.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| SCM | 2023-12-22 | 3.0 | 1 | 30.6 | 20.2 |

| SCM | 2023-12-21 | 3.0 | 1 | 30.4 | 20.1 |

| SCM | 2023-12-20 | 3.0 | 1 | 30.6 | 20.1 |

| SCM | 2023-12-19 | 3.1 | 1 | 30.8 | 20.2 |

| SCM | 2023-12-18 | 3.0 | 1 | 30.8 | 20.2 |

| SCM | 2023-12-15 | 3.0 | 1 | 30.5 | 20.1 |

SCM Growth Metrics

- Its 4 year cash and equivalents growth rate is now at 204.86%.

- The year over year price growth rate now stands at -2.09%.

- The 4 year price growth rate now stands at -48.16%.

The table below shows SCM's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 69.30313 | -66.62371 | 20.76306 |

| 2022-06-30 | 66.19021 | -38.49585 | 29.58615 |

| 2022-03-31 | 65.18553 | -81.97539 | 33.85725 |

| 2021-12-31 | 63.67899 | -76.10274 | 33.57287 |

| 2021-09-30 | 59.66082 | -117.9973 | 40.13418 |

| 2021-06-30 | 56.64823 | -105.6456 | 34.86424 |

SCM's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- SCM has a Quality Grade of C, ranking ahead of 46.4% of graded US stocks.

- SCM's asset turnover comes in at 0.078 -- ranking 263rd of 444 Trading stocks.

- UDR, EPR, and CGBD are the stocks whose asset turnover ratios are most correlated with SCM.

The table below shows SCM's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.078 | 0.745 | 0.049 |

| 2021-06-30 | 0.078 | 0.761 | 0.046 |

| 2021-03-31 | 0.080 | 0.763 | 0.081 |

| 2020-12-31 | 0.085 | 0.766 | 0.036 |

| 2020-09-30 | 0.089 | 0.769 | 0.022 |

| 2020-06-30 | 0.093 | 0.761 | 0.024 |

SCM Price Target

For more insight on analysts targets of SCM, see our SCM price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $14.30 | Average Broker Recommendation | 1.6 (Moderate Buy) |

Stellus Capital Investment Corporation (SCM) Company Bio

Stellus Capital Investment Corporation is a business development company specializing in investments in private middle-market companies. It invests through first lien, second lien, unitranche, and mezzanine debt financing, often with a corresponding equity investment. The company was founded in 2012 and is based in Houston, Texas.

Latest SCM News From Around the Web

Below are the latest news stories about STELLUS CAPITAL INVESTMENT CORP that investors may wish to consider to help them evaluate SCM as an investment opportunity.

13 Cheap Monthly Dividend Stocks to BuyIn this article, we discuss 13 cheap monthly dividend stocks to buy. You can skip our detailed analysis of dividend stocks and their previous performance, and go directly to read 5 Cheap Monthly Dividend Stocks to Buy. According to a Wisdom Tree report, dividends have increased by an average of 5.7% annually since 1957—over 2% […] |

Stellus Capital Investment Corporation (NYSE:SCM) Q3 2023 Earnings Call TranscriptStellus Capital Investment Corporation (NYSE:SCM) Q3 2023 Earnings Call Transcript November 8, 2023 Operator: Good morning, ladies and gentlemen, and thank you for standing by. At this time, I would like to welcome everyone to Stellus Capital Investment Corporation’s Conference Call to Report Financial Results for its Third Fiscal Quarter Ended September 30, 2023. [Operator […] |

Q3 2023 Stellus Capital Investment Corp Earnings CallQ3 2023 Stellus Capital Investment Corp Earnings Call |

Stellus Capital Investment Corporation Reports Results for its Third Fiscal Quarter Ended September 30, 2023Stellus Capital Investment Corporation (NYSE:SCM) ("Stellus" or the "Company") today announced financial results for its third fiscal quarter ended September 30, 2023. |

Stellus Capital Investment Corporation Schedules Third Quarter 2023 Financial Results Conference CallStellus Capital Investment Corporation (NYSE: SCM) will release its financial results for the third quarter ended September 30, 2023 on Tuesday, November 7, 2023, after the close of the stock market. |

SCM Price Returns

| 1-mo | 0.38% |

| 3-mo | 4.64% |

| 6-mo | -2.73% |

| 1-year | -7.08% |

| 3-year | 52.79% |

| 5-year | 45.73% |

| YTD | 2.10% |

| 2023 | 8.68% |

| 2022 | 12.87% |

| 2021 | 30.09% |

| 2020 | -14.13% |

| 2019 | 20.97% |

SCM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SCM

Want to do more research on Stellus Capital Investment Corp's stock and its price? Try the links below:Stellus Capital Investment Corp (SCM) Stock Price | Nasdaq

Stellus Capital Investment Corp (SCM) Stock Quote, History and News - Yahoo Finance

Stellus Capital Investment Corp (SCM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...