New Mountain Finance Corporation (NMFC): Price and Financial Metrics

NMFC Price/Volume Stats

| Current price | $12.64 | 52-week high | $13.23 |

| Prev. close | $12.77 | 52-week low | $11.27 |

| Day low | $12.63 | Volume | 477,200 |

| Day high | $12.79 | Avg. volume | 326,897 |

| 50-day MA | $12.85 | Dividend yield | 10.13% |

| 200-day MA | $12.63 | Market Cap | 1.28B |

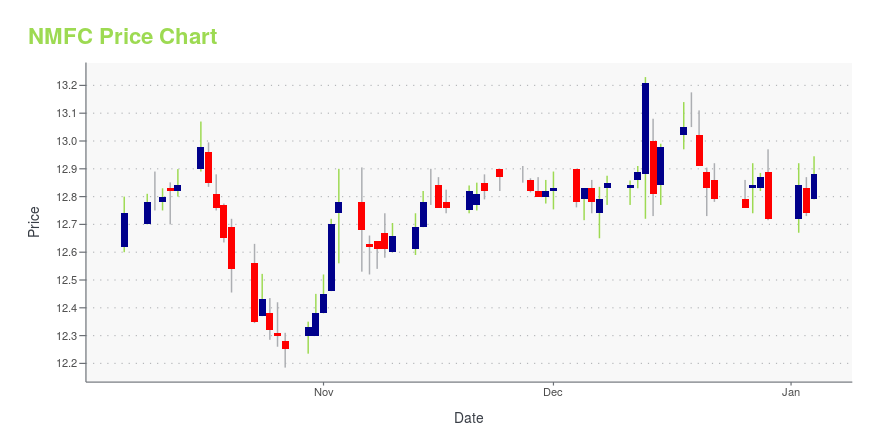

NMFC Stock Price Chart Interactive Chart >

NMFC POWR Grades

- NMFC scores best on the Stability dimension, with a Stability rank ahead of 80.09% of US stocks.

- NMFC's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- NMFC's current lowest rank is in the Sentiment metric (where it is better than 25.69% of US stocks).

NMFC Stock Summary

- For NMFC, its debt to operating expenses ratio is greater than that reported by 99.6% of US equities we're observing.

- The volatility of NEW MOUNTAIN FINANCE CORP's share price is greater than that of merely 0.57% US stocks with at least 200 days of trading history.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for NMFC comes in at 16.19% -- higher than that of 89.75% of stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to NEW MOUNTAIN FINANCE CORP are GSBD, FSK, GBDC, OCSL, and ARCC.

- Visit NMFC's SEC page to see the company's official filings. To visit the company's web site, go to www.newmountainfinance.com.

NMFC Valuation Summary

- In comparison to the median Financial Services stock, NMFC's price/sales ratio is 200% higher, now standing at 3.6.

- NMFC's price/earnings ratio has moved up 1.1 over the prior 115 months.

Below are key valuation metrics over time for NMFC.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| NMFC | 2023-12-22 | 3.6 | 1 | 10.5 | 12.1 |

| NMFC | 2023-12-21 | 3.7 | 1 | 10.6 | 12.2 |

| NMFC | 2023-12-20 | 3.7 | 1 | 10.6 | 12.2 |

| NMFC | 2023-12-19 | 3.7 | 1 | 10.8 | 12.3 |

| NMFC | 2023-12-18 | 3.7 | 1 | 10.8 | 12.3 |

| NMFC | 2023-12-15 | 3.7 | 1 | 10.7 | 12.2 |

NMFC Growth Metrics

- The 3 year net cashflow from operations growth rate now stands at 75.16%.

- Its 2 year net income to common stockholders growth rate is now at 279.44%.

- Its 4 year net income to common stockholders growth rate is now at -177.37%.

The table below shows NMFC's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 294.63 | 35.006 | 74.732 |

| 2022-09-30 | 288.738 | -115.596 | 112.101 |

| 2022-06-30 | 278.763 | -91.81 | 126.243 |

| 2022-03-31 | 272.214 | -111.516 | 186.101 |

| 2021-12-31 | 270.959 | -22.057 | 201.399 |

| 2021-09-30 | 270.882 | 116.129 | 215.308 |

NMFC's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- NMFC has a Quality Grade of C, ranking ahead of 59.15% of graded US stocks.

- NMFC's asset turnover comes in at 0.086 -- ranking 246th of 444 Trading stocks.

- MAA, BLK, and HLNE are the stocks whose asset turnover ratios are most correlated with NMFC.

The table below shows NMFC's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.086 | 0.746 | 0.073 |

| 2021-03-31 | 0.088 | 0.748 | 0.075 |

| 2020-12-31 | 0.090 | 0.750 | 0.028 |

| 2020-09-30 | 0.090 | 0.754 | 0.019 |

| 2020-06-30 | 0.092 | 0.755 | 0.007 |

| 2020-03-31 | 0.093 | 0.759 | -0.004 |

NMFC Price Target

For more insight on analysts targets of NMFC, see our NMFC price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $13.58 | Average Broker Recommendation | 1.5 (Moderate Buy) |

New Mountain Finance Corporation (NMFC) Company Bio

New Mountain Finance Corporation is a is a closed-end, non-diversified management investment firm. The Company's investment objective is to generate current income and capital appreciation through investments in debt securities. The company was founded in 2008 is based in New York, New York.

Latest NMFC News From Around the Web

Below are the latest news stories about NEW MOUNTAIN FINANCE CORP that investors may wish to consider to help them evaluate NMFC as an investment opportunity.

New Mountain Finance Corporation Declares a Special Distribution and Announces the Extension of its Stock Repurchase ProgramNEW YORK, December 13, 2023--New Mountain Finance Corporation (NASDAQ: NMFC) ("NMFC" or "the Company") today announced that on December 8, 2023, its board of directors declared a special distribution of the Company’s excess undistributed taxable income. The special distribution will be in the amount of $0.10 per share payable on December 29, 2023 to shareholders of record as of December 22, 2023. The special distribution is driven primarily from the gain realized on our investment in Haven Midst |

New Mountain Finance Corporation Appoints Kris Corbett as Chief Financial OfficerNEW YORK, November 22, 2023--New Mountain Finance Corporation (NASDAQ: NMFC) ("New Mountain"), the publicly traded credit BDC arm of New Mountain Capital, today announced the appointment of Kris Corbett as Chief Financial Officer, effective November 27, 2023. |

New Mountain Finance Corporation Prices Public Offering of $115.0 Million 8.250% Notes Due 2028NEW YORK, November 06, 2023--New Mountain Finance Corporation (the "Company," "we," "us" or "our") (Nasdaq: NMFC) today announced that it has priced an underwritten public offering of $115.0 million in aggregate principal amount of 8.250% unsecured notes due 2028 (the "Notes"). |

New Mountain Finance Corporation (NASDAQ:NMFC) Q3 2023 Earnings Call TranscriptNew Mountain Finance Corporation (NASDAQ:NMFC) Q3 2023 Earnings Call Transcript November 3, 2023 Operator: Good morning, everyone, and welcome to the New Mountain Finance Corporation’s Third Quarter 2023 Earnings Conference Call. All participants will be in listen-only mode. [Operator Instructions] After today’s presentation, there will be an opportunity to ask questions. Please note this event […] |

Q3 2023 New Mountain Finance Corp Earnings CallQ3 2023 New Mountain Finance Corp Earnings Call |

NMFC Price Returns

| 1-mo | -1.63% |

| 3-mo | 2.23% |

| 6-mo | 5.59% |

| 1-year | 10.63% |

| 3-year | 40.17% |

| 5-year | 52.70% |

| YTD | -0.63% |

| 2023 | 15.83% |

| 2022 | -0.55% |

| 2021 | 31.94% |

| 2020 | -7.13% |

| 2019 | 20.64% |

NMFC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NMFC

Want to see what other sources are saying about New Mountain Finance Corp's financials and stock price? Try the links below:New Mountain Finance Corp (NMFC) Stock Price | Nasdaq

New Mountain Finance Corp (NMFC) Stock Quote, History and News - Yahoo Finance

New Mountain Finance Corp (NMFC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...