First Busey Corporation (BUSE): Price and Financial Metrics

BUSE Price/Volume Stats

| Current price | $23.21 | 52-week high | $25.80 |

| Prev. close | $23.55 | 52-week low | $16.26 |

| Day low | $23.00 | Volume | 108,000 |

| Day high | $23.52 | Avg. volume | 173,294 |

| 50-day MA | $23.99 | Dividend yield | 4.14% |

| 200-day MA | $21.11 | Market Cap | 1.28B |

BUSE Stock Price Chart Interactive Chart >

BUSE POWR Grades

- Stability is the dimension where BUSE ranks best; there it ranks ahead of 75.9% of US stocks.

- The strongest trend for BUSE is in Growth, which has been heading down over the past 26 weeks.

- BUSE ranks lowest in Quality; there it ranks in the 19th percentile.

BUSE Stock Summary

- With a one year PEG ratio of 139.84, FIRST BUSEY CORP is expected to have a higher PEG ratio (a measure of how expensive a stock is relative to its expected earnings growth) than 79.84% of US stocks.

- BUSE's equity multiplier -- a measure of assets relative to shareholders'equity -- is greater than that of 90.67% of US stocks.

- FIRST BUSEY CORP's shareholder yield -- a measure of how much capital is returned to stockholders via dividends and buybacks -- is 9.2%, greater than the shareholder yield of 82.17% of stocks in our set.

- If you're looking for stocks that are quantitatively similar to FIRST BUSEY CORP, a group of peers worth examining would be SPFI, PFC, TBBK, CCBG, and GNTY.

- BUSE's SEC filings can be seen here. And to visit FIRST BUSEY CORP's official web site, go to www.busey.com.

BUSE Valuation Summary

- BUSE's EV/EBIT ratio is 9.5; this is 20.5% lower than that of the median Financial Services stock.

- Over the past 243 months, BUSE's price/earnings ratio has gone down 8.1.

Below are key valuation metrics over time for BUSE.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| BUSE | 2023-12-22 | 3.1 | 1.2 | 10.6 | 9.5 |

| BUSE | 2023-12-21 | 3.1 | 1.2 | 10.5 | 9.4 |

| BUSE | 2023-12-20 | 3.0 | 1.2 | 10.4 | 9.3 |

| BUSE | 2023-12-19 | 3.1 | 1.2 | 10.6 | 9.5 |

| BUSE | 2023-12-18 | 3.0 | 1.1 | 10.3 | 9.3 |

| BUSE | 2023-12-15 | 3.0 | 1.1 | 10.3 | 9.2 |

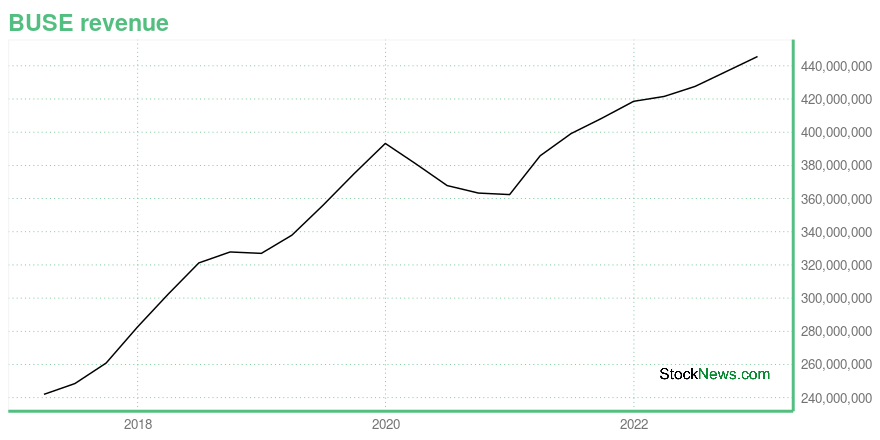

BUSE Growth Metrics

- Its 5 year net income to common stockholders growth rate is now at 70.58%.

- Its year over year price growth rate is now at -10.88%.

- Its 4 year net cashflow from operations growth rate is now at -60.08%.

The table below shows BUSE's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 445.618 | 165.787 | 128.311 |

| 2022-09-30 | 436.582 | 177.534 | 123.85 |

| 2022-06-30 | 427.591 | 153.429 | 114.13 |

| 2022-03-31 | 421.55 | 158.98 | 114.072 |

| 2021-12-31 | 418.603 | 162.012 | 123.449 |

| 2021-09-30 | 408.564 | 170.381 | 121.868 |

BUSE's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- BUSE has a Quality Grade of C, ranking ahead of 31.08% of graded US stocks.

- BUSE's asset turnover comes in at 0.035 -- ranking 280th of 428 Banking stocks.

- FCNCA, BANR, and BCOR are the stocks whose asset turnover ratios are most correlated with BUSE.

The table below shows BUSE's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.035 | 1 | 0.014 |

| 2021-06-30 | 0.036 | 1 | 0.015 |

| 2021-03-31 | 0.036 | 1 | 0.016 |

| 2020-12-31 | 0.035 | 1 | 0.013 |

| 2020-09-30 | 0.036 | 1 | 0.013 |

| 2020-06-30 | 0.037 | 1 | 0.013 |

BUSE Price Target

For more insight on analysts targets of BUSE, see our BUSE price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $27.83 | Average Broker Recommendation | 1.57 (Moderate Buy) |

First Busey Corporation (BUSE) Company Bio

First Busey Corporation offers retail and commercial banking products and services to individual, corporate, institutional, and governmental customers in Illinois, Florida, and Indiana. The company was founded in 1868 and is based in Champaign, Illinois.

Latest BUSE News From Around the Web

Below are the latest news stories about FIRST BUSEY CORP that investors may wish to consider to help them evaluate BUSE as an investment opportunity.

Strength Seen in First Busey (BUSE): Can Its 5.2% Jump Turn into More Strength?First Busey (BUSE) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions could translate into further price increase in the near term. |

Independent Lead Director of First Busey Stanley Bradshaw Buys 5.5% More SharesPotential First Busey Corporation ( NASDAQ:BUSE ) shareholders may wish to note that the Independent Lead Director... |

Insider Sell Alert: Director Michael Cassens Sells Shares of First Busey Corp (BUSE)In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. |

First Busey (BUSE) to Acquire Merchants & Manufacturers BankFirst Busey (BUSE) signs a merger agreement with Merchants & Manufacturers Bank. The total deal value is approximately $41.6 million and is expected to close in the second quarter of 2024. |

First Busey Corporation and Merchants and Manufacturers Bank Corporation to MergeFirst Busey Expands Market Presence in Chicago MSA and Adds Life Equity Loan® Products to Suite of ServicesCHAMPAIGN, Ill. and OAKBROOK TERRACE, Ill., Nov. 27, 2023 (GLOBE NEWSWIRE) -- First Busey Corporation (“Busey”) (NASDAQ:BUSE), the holding company for Busey Bank, and Merchants and Manufacturers Bank Corporation (”M&M”), the holding company for Merchants & Manufacturers Bank (“M&M Bank”), today jointly announced the signing of a definitive agreement pursuant to which Busey will acquire M&M |

BUSE Price Returns

| 1-mo | -1.82% |

| 3-mo | 11.20% |

| 6-mo | 17.83% |

| 1-year | -2.19% |

| 3-year | 15.81% |

| 5-year | 2.36% |

| YTD | -5.51% |

| 2023 | 5.07% |

| 2022 | -5.49% |

| 2021 | 30.66% |

| 2020 | -17.89% |

| 2019 | 15.79% |

BUSE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching BUSE

Here are a few links from around the web to help you further your research on First Busey Corp's stock as an investment opportunity:First Busey Corp (BUSE) Stock Price | Nasdaq

First Busey Corp (BUSE) Stock Quote, History and News - Yahoo Finance

First Busey Corp (BUSE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...