LCNB Corporation (LCNB): Price and Financial Metrics

LCNB Price/Volume Stats

| Current price | $14.51 | 52-week high | $18.82 |

| Prev. close | $14.63 | 52-week low | $12.78 |

| Day low | $14.40 | Volume | 12,700 |

| Day high | $14.58 | Avg. volume | 23,300 |

| 50-day MA | $15.26 | Dividend yield | 6.06% |

| 200-day MA | $15.05 | Market Cap | 161.41M |

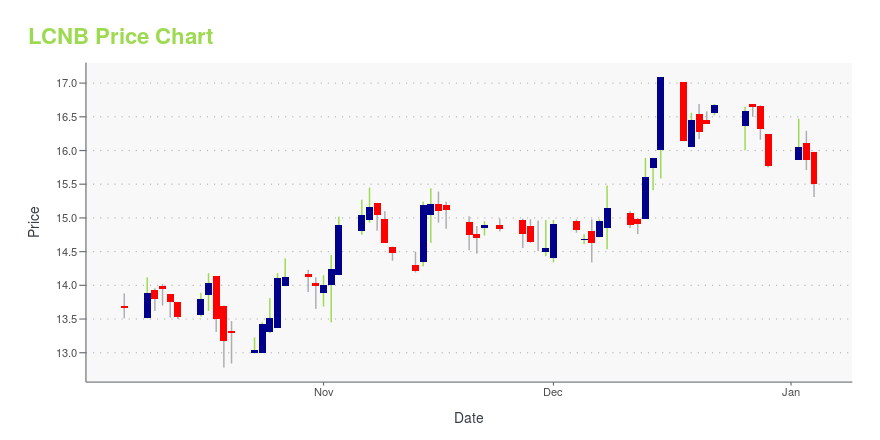

LCNB Stock Price Chart Interactive Chart >

LCNB POWR Grades

- Stability is the dimension where LCNB ranks best; there it ranks ahead of 88.26% of US stocks.

- LCNB's strongest trending metric is Growth; it's been moving down over the last 26 weeks.

- LCNB's current lowest rank is in the Quality metric (where it is better than 9.47% of US stocks).

LCNB Stock Summary

- LCNB's equity multiplier -- a measure of assets relative to shareholders'equity -- is greater than that of 89.2% of US stocks.

- With a year-over-year growth in debt of 329.83%, LCNB CORP's debt growth rate surpasses 97.14% of about US stocks.

- Shareholder yield, a measure of how much is returned to shareholders via dividends and share repurchases, for LCNB comes in at -57.31% -- higher than that of just 7.17% of stocks in our set.

- If you're looking for stocks that are quantitatively similar to LCNB CORP, a group of peers worth examining would be AROW, MRBK, SYBT, PEBO, and BMRC.

- Visit LCNB's SEC page to see the company's official filings. To visit the company's web site, go to www.lcnb.com.

LCNB Valuation Summary

- LCNB's price/sales ratio is 2.6; this is 116.67% higher than that of the median Financial Services stock.

- LCNB's price/earnings ratio has moved down 7.8 over the prior 243 months.

Below are key valuation metrics over time for LCNB.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| LCNB | 2023-12-22 | 2.6 | 0.9 | 9.6 | 12.3 |

| LCNB | 2023-12-21 | 2.5 | 0.9 | 9.4 | 12.2 |

| LCNB | 2023-12-20 | 2.5 | 0.9 | 9.4 | 12.2 |

| LCNB | 2023-12-19 | 2.5 | 0.9 | 9.5 | 12.2 |

| LCNB | 2023-12-18 | 2.5 | 0.9 | 9.3 | 12.1 |

| LCNB | 2023-12-15 | 2.6 | 0.9 | 9.8 | 12.5 |

LCNB Growth Metrics

- The 2 year cash and equivalents growth rate now stands at -19.58%.

- The 5 year net income to common stockholders growth rate now stands at 51.29%.

- The 3 year net cashflow from operations growth rate now stands at -10.96%.

The table below shows LCNB's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-09-30 | 74.389 | 21.374 | 21.347 |

| 2022-06-30 | 73.08 | 21.593 | 20.585 |

| 2022-03-31 | 73.46 | 18.385 | 20.257 |

| 2021-12-31 | 73.625 | 17.821 | 20.974 |

| 2021-09-30 | 73.429 | 19.159 | 21.089 |

| 2021-06-30 | 72.387 | 16.305 | 20.522 |

LCNB's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- LCNB has a Quality Grade of C, ranking ahead of 32.32% of graded US stocks.

- LCNB's asset turnover comes in at 0.041 -- ranking 163rd of 430 Banking stocks.

- MCB, WRLD, and FMAO are the stocks whose asset turnover ratios are most correlated with LCNB.

The table below shows LCNB's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.041 | 1 | 0.015 |

| 2021-03-31 | 0.040 | 1 | 0.015 |

| 2020-12-31 | 0.041 | 1 | 0.015 |

| 2020-09-30 | 0.040 | 1 | 0.014 |

| 2020-06-30 | 0.041 | 1 | 0.015 |

| 2020-03-31 | 0.041 | 1 | 0.015 |

LCNB Price Target

For more insight on analysts targets of LCNB, see our LCNB price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $19.00 | Average Broker Recommendation | 1.5 (Moderate Buy) |

LCNB Corporation (LCNB) Company Bio

LCNB Corp. operates as the financial holding company for LCNB National Bank that provides commercial and personal banking services in Ohio. The company was founded in 1877 and is based in Lebanon, Ohio.

Latest LCNB News From Around the Web

Below are the latest news stories about LCNB CORP that investors may wish to consider to help them evaluate LCNB as an investment opportunity.

Citi (C) Partners With Traydstream to Automate Document ServicesCitigroup (C) teams up with Traydstream to provide a cloud-based trade documentation platform. |

Banc of California (BANC) Closes Buyout of PacWest BancorpBanc of California (BANC) completes the acquisition of PacWest Bancorp. The all-stock deal, announced in July, will serve the banking needs of small and medium-sized businesses in California. |

LCNB Corp (LCNB) Enters Deal to Acquire Eagle FinancialLCNB Corp (LCNB) agrees to acquire Eagle Financial in a stock-and-cash transaction valued at $23.1 million. The deal is expected to close in the second quarter of 2024. |

LCNB Corp. Agrees to Acquire Eagle Financial Bancorp, Inc.LEBANON, Ohio & CINCINNATI, November 29, 2023--LCNB Corp. ("LCNB") (NASDAQ: LCNB), the holding company for LCNB National Bank, and Eagle Financial Bancorp, Inc. ("EFBI" or "Eagle") (OTCQB: EFBI), the holding company for EAGLE.bank, announced today that they have signed a definitive merger agreement whereby LCNB will acquire EFBI in a stock-and-cash transaction. EAGLE.bank operates three full-service banking offices in Cincinnati, Ohio. EFBI had approximately $175.8 million in assets, $140.8 mill |

Is It Smart To Buy LCNB Corp. (NASDAQ:LCNB) Before It Goes Ex-Dividend?LCNB Corp. ( NASDAQ:LCNB ) stock is about to trade ex-dividend in three days. The ex-dividend date is one business day... |

LCNB Price Returns

| 1-mo | -4.48% |

| 3-mo | 0.18% |

| 6-mo | -5.81% |

| 1-year | -18.58% |

| 3-year | -0.41% |

| 5-year | 8.82% |

| YTD | -7.99% |

| 2023 | -7.48% |

| 2022 | -3.37% |

| 2021 | 38.78% |

| 2020 | -20.20% |

| 2019 | 32.62% |

LCNB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LCNB

Here are a few links from around the web to help you further your research on Lcnb Corp's stock as an investment opportunity:Lcnb Corp (LCNB) Stock Price | Nasdaq

Lcnb Corp (LCNB) Stock Quote, History and News - Yahoo Finance

Lcnb Corp (LCNB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...