NAPCO Security Technologies, Inc. (NSSC): Price and Financial Metrics

NSSC Price/Volume Stats

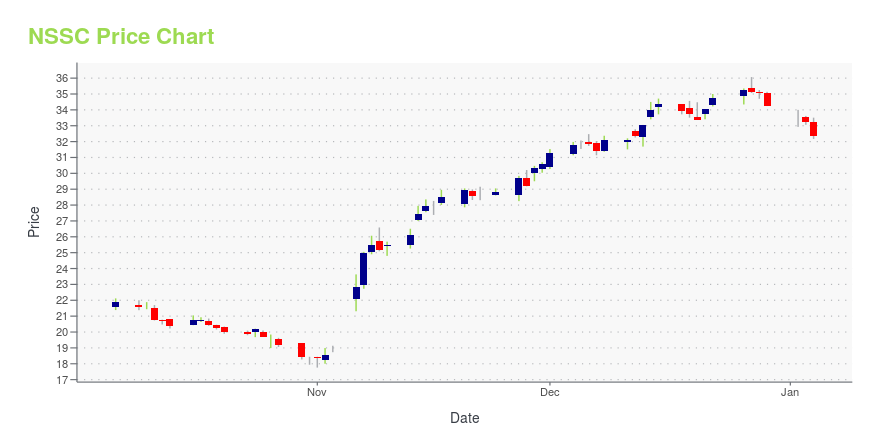

| Current price | $43.97 | 52-week high | $46.26 |

| Prev. close | $45.12 | 52-week low | $17.76 |

| Day low | $43.86 | Volume | 312,600 |

| Day high | $45.25 | Avg. volume | 294,212 |

| 50-day MA | $35.97 | Dividend yield | 0.73% |

| 200-day MA | $31.36 | Market Cap | 1.62B |

NSSC Stock Price Chart Interactive Chart >

NSSC POWR Grades

- NSSC scores best on the Quality dimension, with a Quality rank ahead of 97.57% of US stocks.

- NSSC's strongest trending metric is Quality; it's been moving up over the last 26 weeks.

- NSSC ranks lowest in Value; there it ranks in the 15th percentile.

NSSC Stock Summary

- The price/operating cash flow metric for NAPCO SECURITY TECHNOLOGIES INC is higher than 87.7% of stocks in our set with a positive cash flow.

- NSSC's equity multiplier -- a measure of assets relative to shareholders'equity -- is greater than that of only 12.59% of US stocks.

- Over the past twelve months, NSSC has reported earnings growth of 79.53%, putting it ahead of 87.46% of US stocks in our set.

- Stocks that are quantitatively similar to NSSC, based on their financial statements, market capitalization, and price volatility, are FEIM, LMAT, CTS, MMSI, and UG.

- Visit NSSC's SEC page to see the company's official filings. To visit the company's web site, go to www.napcosecurity.com.

NSSC Valuation Summary

- NSSC's price/sales ratio is 7.3; this is 508.33% higher than that of the median Industrials stock.

- Over the past 243 months, NSSC's EV/EBIT ratio has gone up 12.4.

Below are key valuation metrics over time for NSSC.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| NSSC | 2023-12-29 | 7.3 | 8.5 | 36.5 | 31.9 |

| NSSC | 2023-12-28 | 7.5 | 8.7 | 37.4 | 32.7 |

| NSSC | 2023-12-27 | 7.5 | 8.7 | 37.4 | 32.8 |

| NSSC | 2023-12-26 | 7.5 | 8.8 | 37.5 | 32.9 |

| NSSC | 2023-12-22 | 7.4 | 8.6 | 37.0 | 32.4 |

| NSSC | 2023-12-21 | 7.3 | 8.5 | 36.3 | 31.7 |

NSSC Growth Metrics

- The 2 year revenue growth rate now stands at 25.81%.

- The year over year net income to common stockholders growth rate now stands at 120.65%.

- The 3 year cash and equivalents growth rate now stands at 666.08%.

The table below shows NSSC's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 160.941 | 1.619 | 25.658 |

| 2022-09-30 | 152.035 | 2.904 | 18.249 |

| 2022-06-30 | 143.593 | 8.332 | 19.599 |

| 2022-03-31 | 135.793 | 14.969 | 17.599 |

| 2021-12-31 | 128.116 | 21.851 | 18.174 |

| 2021-09-30 | 121.913 | 22.685 | 20.334 |

NSSC's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- NSSC has a Quality Grade of A, ranking ahead of 96.4% of graded US stocks.

- NSSC's asset turnover comes in at 1.009 -- ranking 41st of 208 Electronic Equipment stocks.

- VPG, EMKR, and KOPN are the stocks whose asset turnover ratios are most correlated with NSSC.

The table below shows NSSC's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 1.009 | 0.440 | 0.230 |

| 2021-03-31 | 0.935 | 0.423 | 0.139 |

| 2020-12-31 | 0.945 | 0.422 | 0.126 |

| 2020-09-30 | 0.947 | 0.435 | 0.130 |

| 2020-06-30 | 0.998 | 0.430 | 0.145 |

| 2020-03-31 | 1.117 | 0.450 | 0.235 |

NSSC Price Target

For more insight on analysts targets of NSSC, see our NSSC price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $48.20 | Average Broker Recommendation | 1.33 (Strong Buy) |

NAPCO Security Technologies, Inc. (NSSC) Company Bio

Napco Security Technologies, Inc. manufactures and sells security products and software worldwide. The company offers access control systems, door security products, intrusion and fire alarm systems, and video surveillance products for use in commercial, residential, institutional, industrial, and governmental applications. The company was founded in 1969 and is based in Amityville, New York.

Latest NSSC News From Around the Web

Below are the latest news stories about NAPCO SECURITY TECHNOLOGIES INC that investors may wish to consider to help them evaluate NSSC as an investment opportunity.

At US$35.25, Is It Time To Put Napco Security Technologies, Inc. (NASDAQ:NSSC) On Your Watch List?Napco Security Technologies, Inc. ( NASDAQ:NSSC ), is not the largest company out there, but it saw a significant share... |

Investors in Napco Security Technologies (NASDAQ:NSSC) have seen incredible returns of 335% over the past five yearsFor many, the main point of investing in the stock market is to achieve spectacular returns. While the best companies... |

NAPCO Security Technologies Ranked in Forbes List of "Americas Most Successful Small-Cap Companies 2024"NAPCO Security Technologies, Inc. (NASDAQ: NSSC), one of the leading designers and manufacturers of high-tech electronic security devices, wireless recurring communication services for intrusion, fire alarm, access control and locking systems as well as a leading provider of school safety solutions has recently been ranked within globally renowned Forbes' magazine's list of America's Most Successful Small-Cap Companies for 2024. |

Napco (NSSC) Upgraded to Strong Buy: Here's What You Should KnowNapco (NSSC) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy). |

Best Momentum Stocks to Buy for November 30thANF, NSSC and CPRT made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on November 30, 2023. |

NSSC Price Returns

| 1-mo | 29.59% |

| 3-mo | 54.15% |

| 6-mo | 87.81% |

| 1-year | 35.50% |

| 3-year | 183.30% |

| 5-year | 316.63% |

| YTD | 28.38% |

| 2023 | 25.60% |

| 2022 | 9.96% |

| 2021 | 90.62% |

| 2020 | -10.79% |

| 2019 | 86.60% |

NSSC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NSSC

Here are a few links from around the web to help you further your research on Napco Security Technologies Inc's stock as an investment opportunity:Napco Security Technologies Inc (NSSC) Stock Price | Nasdaq

Napco Security Technologies Inc (NSSC) Stock Quote, History and News - Yahoo Finance

Napco Security Technologies Inc (NSSC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...