Diamondback Energy Inc. (FANG): Price and Financial Metrics

FANG Price/Volume Stats

| Current price | $179.42 | 52-week high | $181.54 |

| Prev. close | $178.52 | 52-week low | $119.01 |

| Day low | $178.07 | Volume | 2,540,900 |

| Day high | $181.54 | Avg. volume | 2,011,385 |

| 50-day MA | $155.12 | Dividend yield | 1.87% |

| 200-day MA | $148.16 | Market Cap | 32.11B |

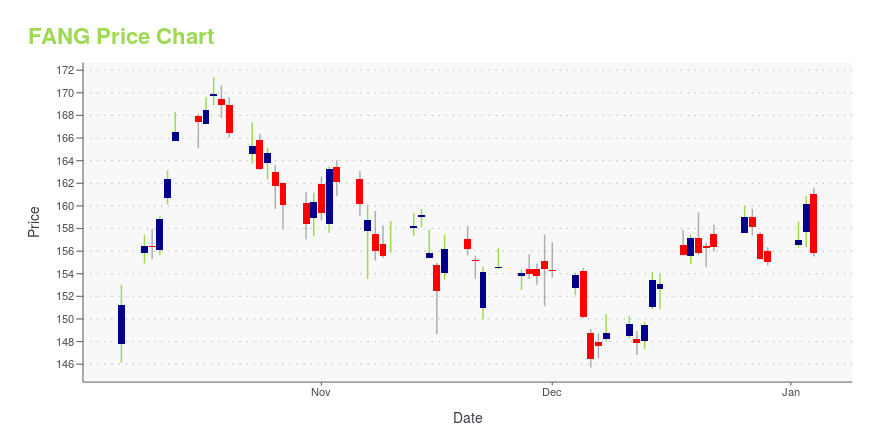

FANG Stock Price Chart Interactive Chart >

FANG POWR Grades

- FANG scores best on the Quality dimension, with a Quality rank ahead of 91.87% of US stocks.

- FANG's strongest trending metric is Growth; it's been moving up over the last 26 weeks.

- FANG's current lowest rank is in the Value metric (where it is better than 14.36% of US stocks).

FANG Stock Summary

- FANG has a higher market value than 91.56% of US stocks; more precisely, its current market capitalization is $28,668,013,195.

- Of note is the ratio of DIAMONDBACK ENERGY INC's sales and general administrative expense to its total operating expenses; only 2.71% of US stocks have a lower such ratio.

- Revenue growth over the past 12 months for DIAMONDBACK ENERGY INC comes in at -14.75%, a number that bests merely 17.18% of the US stocks we're tracking.

- Stocks with similar financial metrics, market capitalization, and price volatility to DIAMONDBACK ENERGY INC are DVN, AVB, ORAN, MRO, and ED.

- FANG's SEC filings can be seen here. And to visit DIAMONDBACK ENERGY INC's official web site, go to www.diamondbackenergy.com.

FANG Valuation Summary

- FANG's price/sales ratio is 3.4; this is 151.85% higher than that of the median Energy stock.

- FANG's price/sales ratio has moved down 6.3 over the prior 135 months.

Below are key valuation metrics over time for FANG.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| FANG | 2023-12-28 | 3.4 | 1.7 | 8.7 | 7.8 |

| FANG | 2023-12-27 | 3.4 | 1.7 | 8.9 | 8.0 |

| FANG | 2023-12-26 | 3.5 | 1.7 | 8.9 | 8.0 |

| FANG | 2023-12-22 | 3.4 | 1.7 | 8.8 | 7.9 |

| FANG | 2023-12-21 | 3.4 | 1.7 | 8.8 | 7.9 |

| FANG | 2023-12-20 | 3.4 | 1.7 | 8.7 | 7.9 |

FANG Growth Metrics

- The year over year net cashflow from operations growth rate now stands at 141.52%.

- The 3 year revenue growth rate now stands at 213.31%.

- The 5 year price growth rate now stands at -55.8%.

The table below shows FANG's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 9,643 | 6,325 | 4,386 |

| 2022-09-30 | 9,635 | 6,051 | 4,381 |

| 2022-06-30 | 9,108 | 5,325 | 3,846 |

| 2022-03-31 | 8,021 | 4,572 | 2,741 |

| 2021-12-31 | 6,797 | 3,944 | 2,182 |

| 2021-09-30 | 5,544 | 3,180 | 441 |

FANG's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- FANG has a Quality Grade of B, ranking ahead of 87.72% of graded US stocks.

- FANG's asset turnover comes in at 0.216 -- ranking 104th of 137 Petroleum and Natural Gas stocks.

- MTDR, LPI, and AXAS are the stocks whose asset turnover ratios are most correlated with FANG.

The table below shows FANG's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.216 | 0.772 | -0.057 |

| 2021-03-31 | 0.157 | 0.728 | -0.199 |

| 2020-12-31 | 0.140 | 0.692 | -0.219 |

| 2020-09-30 | 0.146 | 0.706 | -0.196 |

| 2020-06-30 | 0.150 | 0.721 | -0.120 |

| 2020-03-31 | 0.171 | 0.755 | 0.011 |

FANG Price Target

For more insight on analysts targets of FANG, see our FANG price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $112.91 | Average Broker Recommendation | 1.41 (Moderate Buy) |

Diamondback Energy Inc. (FANG) Company Bio

Diamondback Energy is a company engaged in hydrocarbon exploration headquartered in Midland, Texas. (Source:Wikipedia)

Latest FANG News From Around the Web

Below are the latest news stories about DIAMONDBACK ENERGY INC that investors may wish to consider to help them evaluate FANG as an investment opportunity.

3 Stocks to Buy as the Nasdaq 100 Hits New All-Time HighAs the markets finish 2023 positively, these Nasdaq 100 stocks are worth investor consideration due to their value. |

13 Most Profitable Oil Stocks in the WorldIn this article, we discuss the 13 most profitable oil stocks in the world. To skip our detailed analysis of the oil and gas sector, go directly to the 5 Most Profitable Oil Stocks in the World. Oil stocks experienced a remarkable performance in 2022, but their fortunes took a downturn in 2023. Despite the […] |

EIA Expects Record Oil & Liquid Exports in '24: 3 Stocks to GainIt is an opportune moment for investors to monitor upstream companies like EOG, MTDR and FANG that will contribute to oil production in the United States. |

Should You Buy the 3 Highest-Paying Dividend Stocks in the Nasdaq-100?Even income investors can find stocks to like in the tech-heavy Nasdaq-100. |

Death Cross Isn't A Death Sentence For Energy StocksDespite its ominous name, the death cross does not necessarily portend that the skies are about to fall; rather, it frequently precedes a near-term rebound with above-average returns |

FANG Price Returns

| 1-mo | 18.77% |

| 3-mo | 15.69% |

| 6-mo | 23.67% |

| 1-year | 40.60% |

| 3-year | 214.65% |

| 5-year | 102.05% |

| YTD | 15.70% |

| 2023 | 19.66% |

| 2022 | 35.34% |

| 2021 | 127.51% |

| 2020 | -46.00% |

| 2019 | 0.92% |

FANG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching FANG

Want to do more research on Diamondback Energy Inc's stock and its price? Try the links below:Diamondback Energy Inc (FANG) Stock Price | Nasdaq

Diamondback Energy Inc (FANG) Stock Quote, History and News - Yahoo Finance

Diamondback Energy Inc (FANG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...