Panhandle Oil and Gas Inc (PHX): Price and Financial Metrics

PHX Price/Volume Stats

| Current price | $2.98 | 52-week high | $3.89 |

| Prev. close | $3.08 | 52-week low | $2.33 |

| Day low | $2.97 | Volume | 59,000 |

| Day high | $3.11 | Avg. volume | 76,352 |

| 50-day MA | $3.21 | Dividend yield | 4.03% |

| 200-day MA | $3.26 | Market Cap | 110.26M |

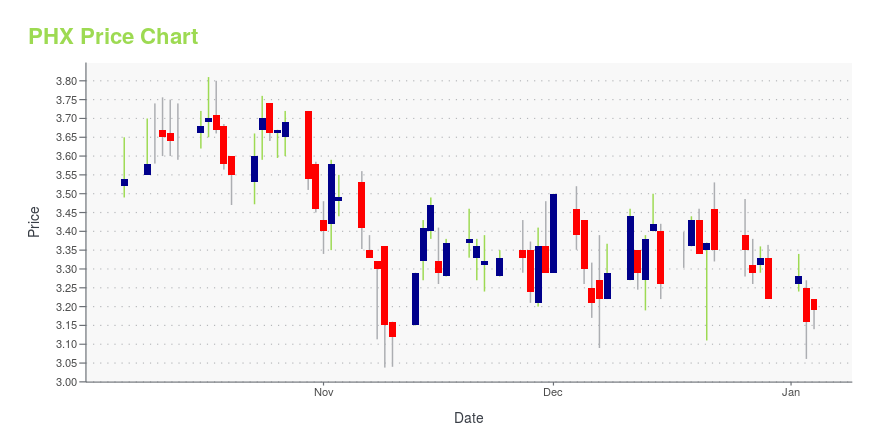

PHX Stock Price Chart Interactive Chart >

PHX POWR Grades

- PHX scores best on the Stability dimension, with a Stability rank ahead of 59.69% of US stocks.

- PHX's strongest trending metric is Quality; it's been moving down over the last 26 weeks.

- PHX ranks lowest in Momentum; there it ranks in the 30th percentile.

PHX Stock Summary

- With a price/earnings ratio of 7.92, PHX MINERALS INC P/E ratio is greater than that of about only 13.38% of stocks in our set with positive earnings.

- Price to trailing twelve month operating cash flow for PHX is currently 3.78, higher than only 13.35% of US stocks with positive operating cash flow.

- Equity multiplier, or assets relative to shareholders' equity, comes in at 1.33 for PHX MINERALS INC; that's greater than it is for only 18.3% of US stocks.

- Stocks with similar financial metrics, market capitalization, and price volatility to PHX MINERALS INC are AMK, EVTC, DAVE, BKSY, and CHUY.

- Visit PHX's SEC page to see the company's official filings. To visit the company's web site, go to www.panhandleoilandgas.com.

PHX Valuation Summary

- PHX's price/sales ratio is 2.4; this is 50% higher than that of the median Energy stock.

- PHX's price/sales ratio has moved down 0.4 over the prior 243 months.

Below are key valuation metrics over time for PHX.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| PHX | 2023-12-28 | 2.4 | 1 | 8.4 | 7.1 |

| PHX | 2023-12-27 | 2.4 | 1 | 8.2 | 7.1 |

| PHX | 2023-12-26 | 2.4 | 1 | 8.4 | 7.2 |

| PHX | 2023-12-22 | 2.4 | 1 | 8.4 | 7.2 |

| PHX | 2023-12-21 | 2.4 | 1 | 8.5 | 7.2 |

| PHX | 2023-12-20 | 2.4 | 1 | 8.4 | 7.2 |

PHX Growth Metrics

- The 2 year cash and equivalents growth rate now stands at 241.57%.

- Its 5 year revenue growth rate is now at 31.51%.

- The 4 year revenue growth rate now stands at 31.51%.

The table below shows PHX's growth in key financial areas (numbers in millions of US dollars).

| Date | Revenue | Operating Cash Flow | Net Income to Common Stock |

|---|---|---|---|

| 2022-12-31 | 55.16297 | 39.03547 | 17.07316 |

| 2022-09-30 | 53.49506 | 37.53165 | 20.40927 |

| 2022-06-30 | 39.70626 | 18.04073 | 7.486604 |

| 2022-03-31 | 28.26414 | 15.1993 | -2.459 |

| 2021-12-31 | 32.38127 | 12.1087 | 1.061732 |

| 2021-09-30 | 21.97167 | 3.942087 | -6.217237 |

PHX's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- PHX has a Quality Grade of C, ranking ahead of 56.99% of graded US stocks.

- PHX's asset turnover comes in at 0.224 -- ranking 100th of 136 Petroleum and Natural Gas stocks.

- NBR, NGS, and CCLP are the stocks whose asset turnover ratios are most correlated with PHX.

The table below shows PHX's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0.224 | 0.521 | -0.042 |

| 2021-03-31 | 0.201 | 0.490 | -0.062 |

| 2020-12-31 | 0.253 | 0.579 | -0.282 |

| 2020-09-30 | 0.277 | 0.631 | -0.239 |

| 2020-06-30 | 0.363 | 0.703 | -0.739 |

| 2020-03-31 | 0.386 | 0.752 | -0.538 |

PHX Price Target

For more insight on analysts targets of PHX, see our PHX price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $4.33 | Average Broker Recommendation | 1.33 (Strong Buy) |

Panhandle Oil and Gas Inc (PHX) Company Bio

Panhandle Oil & Gas acquires, develops, and manages oil and natural gas properties in the United States. The company was founded in 1926 and is based in Oklahoma City, Oklahoma.

Latest PHX News From Around the Web

Below are the latest news stories about PHX MINERALS INC that investors may wish to consider to help them evaluate PHX as an investment opportunity.

7 Penny Stocks You’ll Regret Not Buying Soon: November 2023Unlock robust upside potential by wagering on these top penny stocks to buy in a volatile market at this time. |

3 Penny Stocks With Potential to 10x in 2024As the new year approaches, here is a list of potential penny stocks winners to get you started with the right foot. |

PHX Minerals Reports Results for the Quarter Ended Sept. 30, 2023; Increases Fixed Quarterly Dividend 33% and Expands Borrowing BasePHX MINERALS INC., "PHX" or the "Company" (NYSE: PHX), today reported financial and operating results for the quarter ended Sept. 30, 2023. |

PHX Minerals Inc.'s (NYSE:PHX) largest shareholders are individual investors with 41% ownership, institutions own 21%Key Insights PHX Minerals' significant individual investors ownership suggests that the key decisions are influenced by... |

PHX Minerals Inc. to Announce Quarterly Financial Results on Nov. 8 and Host Earnings Call on Nov. 9PHX MINERALS INC., "PHX," (NYSE: PHX), today announced it will release results for the quarter ended Sept. 30, 2023, following the close of market on Wednesday, Nov. 8, 2023. |

PHX Price Returns

| 1-mo | -8.59% |

| 3-mo | -11.31% |

| 6-mo | -6.62% |

| 1-year | 1.73% |

| 3-year | -4.76% |

| 5-year | -79.53% |

| YTD | -7.45% |

| 2023 | -14.60% |

| 2022 | 83.44% |

| 2021 | -4.32% |

| 2020 | -79.09% |

| 2019 | -26.79% |

PHX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PHX

Want to do more research on Panhandle Oil & Gas Inc's stock and its price? Try the links below:Panhandle Oil & Gas Inc (PHX) Stock Price | Nasdaq

Panhandle Oil & Gas Inc (PHX) Stock Quote, History and News - Yahoo Finance

Panhandle Oil & Gas Inc (PHX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...