Broadstone Net Lease Inc. (BNL): Price and Financial Metrics

BNL Price/Volume Stats

| Current price | $15.63 | 52-week high | $18.46 |

| Prev. close | $15.81 | 52-week low | $13.68 |

| Day low | $15.48 | Volume | 1,234,400 |

| Day high | $15.78 | Avg. volume | 962,476 |

| 50-day MA | $16.64 | Dividend yield | 7.29% |

| 200-day MA | $15.88 | Market Cap | 2.93B |

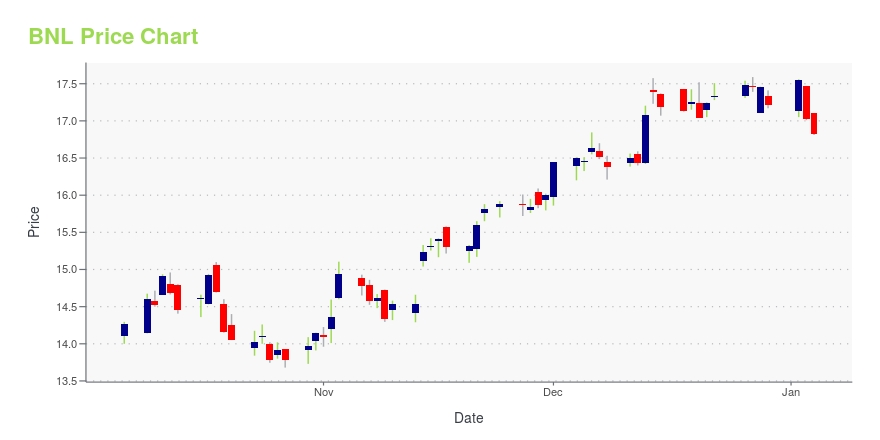

BNL Stock Price Chart Interactive Chart >

BNL POWR Grades

- Sentiment is the dimension where BNL ranks best; there it ranks ahead of 96.33% of US stocks.

- BNL's strongest trending metric is Growth; it's been moving down over the last 26 weeks.

- BNL ranks lowest in Value; there it ranks in the 36th percentile.

BNL Stock Summary

- BROADSTONE NET LEASE INC's stock had its IPO on September 17, 2020, making it an older stock than just 13.56% of US equities in our set.

- For BNL, its debt to operating expenses ratio is greater than that reported by 98.11% of US equities we're observing.

- In terms of volatility of its share price, BNL is more volatile than merely 8.02% of stocks we're observing.

- Stocks that are quantitatively similar to BNL, based on their financial statements, market capitalization, and price volatility, are GHI, AIU, MBI, MAIN, and MAA.

- BNL's SEC filings can be seen here. And to visit BROADSTONE NET LEASE INC's official web site, go to www.broadstone.com.

BNL Valuation Summary

- BNL's price/sales ratio is 7.2; this is 500% higher than that of the median Real Estate stock.

- BNL's price/sales ratio has moved up 1.7 over the prior 40 months.

Below are key valuation metrics over time for BNL.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| BNL | 2023-12-29 | 7.2 | 1 | 17.6 | 18.8 |

| BNL | 2023-12-28 | 7.3 | 1 | 17.8 | 19.0 |

| BNL | 2023-12-27 | 7.3 | 1 | 17.8 | 19.0 |

| BNL | 2023-12-26 | 7.3 | 1 | 17.8 | 19.0 |

| BNL | 2023-12-22 | 7.2 | 1 | 17.7 | 18.9 |

| BNL | 2023-12-21 | 7.2 | 1 | 17.6 | 18.9 |

BNL's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- BNL has a Quality Grade of C, ranking ahead of 32.7% of graded US stocks.

- BNL's asset turnover comes in at 0.086 -- ranking 245th of 444 Trading stocks.

- SITC, LSI, and GNL are the stocks whose asset turnover ratios are most correlated with BNL.

The table below shows BNL's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-09-30 | 0.086 | 0.603 | 0.030 |

| 2021-06-30 | 0.077 | 0.571 | 0.027 |

| 2021-03-31 | 0.078 | 0.540 | 0.026 |

| 2020-12-31 | 0.076 | 0.522 | 0.024 |

| 2020-09-30 | 0.078 | 0.500 | 0.027 |

| 2020-06-30 | 0.078 | 0.479 | 0.028 |

BNL Price Target

For more insight on analysts targets of BNL, see our BNL price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $26.29 | Average Broker Recommendation | 1.67 (Moderate Buy) |

Broadstone Net Lease Inc. (BNL) Company Bio

BNL is an internally-managed REIT that acquires, owns, and manages primarily single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants. BNL utilizes an investment strategy underpinned by strong fundamental credit analysis and prudent real estate underwriting. As of June 30, 2020, BNL's diversified portfolio consisted of 632 properties in 41 U.S. states and one property in Canada across the industrial, healthcare, restaurant, office, and retail property types, with an aggregate gross asset value of approximately $4.0 billion.

Latest BNL News From Around the Web

Below are the latest news stories about BROADSTONE NET LEASE INC that investors may wish to consider to help them evaluate BNL as an investment opportunity.

JP Morgan Upgrades Six REITs To Start The WeekWith real estate investment trusts (REITs) showing strength following the Federal Reserve's recent announcement of three possible rate cuts in 2024, analysts are scurrying to update their ratings on REITs. A positive start to the week was solidified by two analysts at JP Morgan upgrading six REITs from a cross-section of REIT subsectors. All six REITs were upgraded from Neutral to Overweight. Take a look at the six REITs receiving upgrades this week. EPR Properties (NYSE:EPR) is a Kansas City, M |

With 82% institutional ownership, Broadstone Net Lease, Inc. (NYSE:BNL) is a favorite amongst the big gunsKey Insights Significantly high institutional ownership implies Broadstone Net Lease's stock price is sensitive to... |

Broadstone Net Lease, Inc. (NYSE:BNL) Q3 2023 Earnings Call TranscriptBroadstone Net Lease, Inc. (NYSE:BNL) Q3 2023 Earnings Call Transcript November 3, 2023 Operator: Hello, and welcome to Broadstone Net Lease’s Third Quarter 2023 Earnings Conference Call. My name is Cole and I’ll be the moderator for today’s call. Please note that today’s call is being recorded. I will now turn the call over to […] |

Favourable Signals For Broadstone Net Lease: Numerous Insiders Acquired StockGenerally, when a single insider buys stock, it is usually not a big deal. However, when several insiders are buying... |

Broadstone Net Lease Inc (BNL) Announces Q3 2023 Earnings: Net Income of $52.1 MillionInvestment Activity and Operating Results Highlighted in the Report |

BNL Price Returns

| 1-mo | -6.07% |

| 3-mo | 1.85% |

| 6-mo | 1.98% |

| 1-year | -8.74% |

| 3-year | -2.19% |

| 5-year | N/A |

| YTD | -9.23% |

| 2023 | 14.00% |

| 2022 | -30.75% |

| 2021 | 32.67% |

| 2020 | N/A |

| 2019 | N/A |

BNL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...