Equillium, Inc. (EQ): Price and Financial Metrics

EQ Price/Volume Stats

| Current price | $2.76 | 52-week high | $2.79 |

| Prev. close | $2.02 | 52-week low | $0.45 |

| Day low | $1.99 | Volume | 1,094,700 |

| Day high | $2.79 | Avg. volume | 421,203 |

| 50-day MA | $0.92 | Dividend yield | N/A |

| 200-day MA | $0.75 | Market Cap | 96.93M |

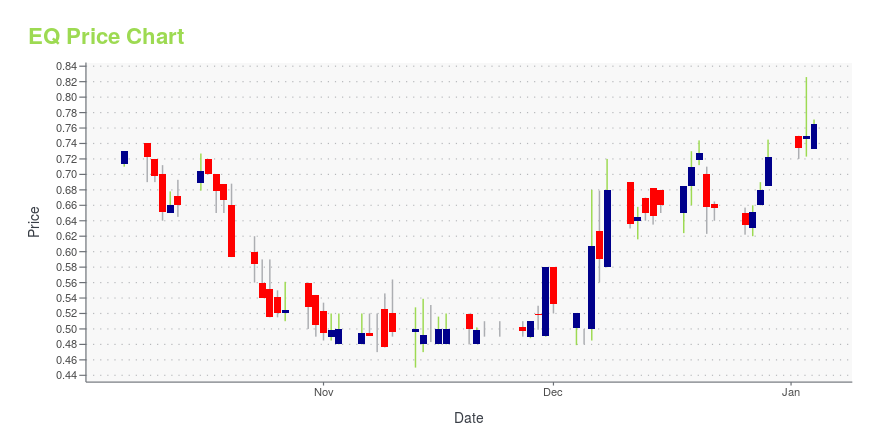

EQ Stock Price Chart Interactive Chart >

EQ Stock Summary

- With a year-over-year growth in debt of -92.07%, EQUILLIUM INC's debt growth rate surpasses merely 1.27% of about US stocks.

- Revenue growth over the past 12 months for EQUILLIUM INC comes in at 170.53%, a number that bests 97.07% of the US stocks we're tracking.

- EQUILLIUM INC's shareholder yield -- a measure of how much capital is returned to stockholders via dividends and buybacks -- is 40.48%, greater than the shareholder yield of 95.41% of stocks in our set.

- Stocks with similar financial metrics, market capitalization, and price volatility to EQUILLIUM INC are MRKR, DBVT, CRDF, CRIS, and DTIL.

- EQ's SEC filings can be seen here. And to visit EQUILLIUM INC's official web site, go to equilliumbio.com.

EQ Valuation Summary

- In comparison to the median Healthcare stock, EQ's EV/EBIT ratio is 91.78% lower, now standing at 1.2.

- Over the past 63 months, EQ's price/earnings ratio has gone up 47.8.

Below are key valuation metrics over time for EQ.

| Stock | Date | P/S | P/B | P/E | EV/EBIT |

|---|---|---|---|---|---|

| EQ | 2023-12-29 | 0.6 | 1.1 | -3.1 | 1.2 |

| EQ | 2023-12-28 | 0.6 | 1.0 | -2.9 | 1.4 |

| EQ | 2023-12-27 | 0.5 | 0.9 | -2.8 | 1.5 |

| EQ | 2023-12-26 | 0.5 | 0.9 | -2.7 | 1.6 |

| EQ | 2023-12-22 | 0.5 | 1.0 | -2.8 | 1.5 |

| EQ | 2023-12-21 | 0.5 | 1.0 | -2.8 | 1.5 |

EQ's Quality Factors

The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.- EQ has a Quality Grade of D, ranking ahead of 13.26% of graded US stocks.

- EQ's asset turnover comes in at 0 -- ranking 440th of 681 Pharmaceutical Products stocks.

- 500 - Internal server error

The table below shows EQ's key quality metrics over time.

| Period | Asset Turnover | Gross Margin | ROIC |

|---|---|---|---|

| 2021-06-30 | 0 | NA | -0.645 |

| 2021-03-31 | 0 | NA | -0.606 |

| 2020-12-31 | 0 | NA | -0.660 |

| 2020-09-30 | 0 | NA | -0.693 |

| 2020-06-30 | 0 | NA | -0.718 |

| 2020-03-31 | 0 | NA | -0.692 |

EQ Price Target

For more insight on analysts targets of EQ, see our EQ price target page. And for a list of of all stocks sorted by upside potential based on analyst target price, see our Top Price Target page.

| Average Price Target | $14.00 | Average Broker Recommendation | 1.3 (Strong Buy) |

Equillium, Inc. (EQ) Company Bio

Equillium Inc. is leveraging deep understanding of immunobiology to develop products for severe autoimmune and inflammatory, or immuno-inflammatory, disorders with high unmet medical need. The company is based in La Jolla, California.

Latest EQ News From Around the Web

Below are the latest news stories about EQUILLIUM INC that investors may wish to consider to help them evaluate EQ as an investment opportunity.

EQ Bank Card launches in Québec as Carte Banque EQEQ Bank (Banque EQ in Québec) is offering Québec customers a new way to earn, save and spend their money, with the introduction of its popular EQ Bank Card1 (Carte Banque EQ). Customers can use the card to withdraw cash for free at any ATM in the country, earn cash back on their spending, earn high interest on their card balance, and travel without paying foreign currency conversion fees. |

Equillium Presents Positive Data from Phase 1b EQUALISE Study at the 2023 Annual Meeting of the American College of RheumatologyLA JOLLA, Calif., November 13, 2023--Equillium, Inc. (Nasdaq: EQ), a clinical-stage biotechnology company focused on developing novel therapeutics to treat severe autoimmune and inflammatory disorders, today announced that data from the Type B portion of the EQUALISE study evaluating itolizumab in lupus nephritis patients was presented at ACR Convergence, the annual meeting of the American College of Rheumatology (ACR). The data presented by Dr. Kenneth Kalunian, Professor, Medicine, UCSD School |

Equillium Reports Third Quarter 2023 Financial Results and Provides Corporate and Clinical UpdatesLA JOLLA, Calif., November 08, 2023--Equillium, Inc. (Nasdaq: EQ), a clinical-stage biotechnology company leveraging a deep understanding of immunobiology to develop novel therapeutics to treat severe autoimmune and inflammatory disorders, today announced financial results for the third quarter 2023 and provided corporate and clinical development updates. |

Equillium Announces Data from Phase 1b EQUALISE Study Presented at the 2023 Annual Meeting of the American Society of NephrologyLA JOLLA, Calif., November 06, 2023--Equillium, Inc. (Nasdaq: EQ), a clinical-stage biotechnology company focused on developing novel therapeutics to treat severe autoimmune and inflammatory disorders, today announced that data from the Type B portion of the EQUALISE study in lupus nephritis patients was presented at the annual meeting of the American Society of Nephrology (ASN). The data highlights that subjects had high complete and partial response rates with rapid and deep reduction in urine |

10 Biotech Stocks Below Cash Value with Key Catalysts on the Horizon: An AnalysisNEW YORK, NY / ACCESSWIRE / October 24, 2023 / The biotech sector, known for its exponential growth potential, is currently facing highly challenging market conditions. Influences like rising inflation, geopolitical tensions, and looming economic ... |

EQ Price Returns

| 1-mo | 232.85% |

| 3-mo | 453.33% |

| 6-mo | 221.12% |

| 1-year | 148.65% |

| 3-year | -70.19% |

| 5-year | -54.30% |

| YTD | 281.74% |

| 2023 | -31.79% |

| 2022 | -71.88% |

| 2021 | -29.53% |

| 2020 | 58.28% |

| 2019 | -58.58% |

Loading social stream, please wait...